Europe is suffering but holding on… (update)

(BRUSSELS2) In the five years of the crisis, the European Union has shown a certain resilience, both political and financial. Some bet on the departure of Greece from the Euro and behind the disintegration of the single currency. They lost. Others predicted the collapse of the European Union, this is not the case. The Cassandres, who have confused their desires with reality, are at their expense. It is worth remembering this May 9, Europe Day.

The political structures, relatively weak and often hesitant, held

After five years of crisis, the political structures are emerging more strengthened than weakened. The President of the European Council, a body whose usefulness one might initially wonder about, has proven its usefulness. The European Commission, asleep, had to "shake its chips". The process of deregulation - a fad and an ideological will rather than an economic necessity - has been frozen. And the machine of regulation, therefore of harmonization, is off again. If the pace continues, the years 2012-2015 should go down in European annals as a moment of integration the likes of which we have not seen for 20 years.

But all is not rosy. The European system is still largely unbalanced, favoring the financial over the economic, the economic over the social. Its political system remains in the middle of the ford. The structures resulting from the Lisbon Treaty have not all proven their effectiveness. Each of the institutions does not fully play the role assigned to it. The Commission, in particular, must thus regain a proactive, dynamic and "intelligent" and non-ideological force (*). The system of "crisis reaction" still depends too much on the atmosphere, on the people, on the will. And there remain organizational "holes" in the system where the executive intertwines with the legislative, and the political with the technical.

The estrangement of Europeans and the world

Finally, and above all, the European structure sometimes appears to be very far removed from everyday reality. This poses a serious problem... Because European sentiment is fraying inside and out. As a result, European power is weakening... We can take two very distinct indicators to account for this development: the attitude of the population (via the latest Eurobarometer surveys, autumn 2012) and foreign exchange reserves ( through IMF statistics).

(*) his last proposal to puncture the Cypriot accounts which comes, largely from the team of Olli Rehn, is more than a mistake. This is a political mistake that should have been punished

* * *

The blurred image of Europe and a growing lack of confidence

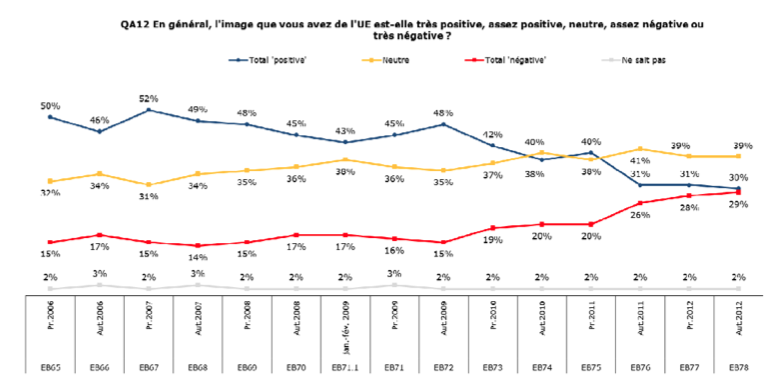

In the population, the image of the European Union has blurred and degraded to a very worrying level. The fall is brutal. Five years ago, the image of Europe was mostly positive (between 45 and 52%). Only a small minority (one sixth of the population) had a negative image of it. And those who had a blurry image of it represented a third of the population.

In 2012, the negative and positive lines meet. Those with a negative image and those with a positive image are equal. And those who are indifferent (or don't care) progress sharply to the point of predominance. NB: Eurostat uses the word "neutral", it's a bit usurped, to be neutral is at best to be indifferent. To have a good understanding of the problem, we can add the rates of negatives and "neutrals". We thus realize that 5 years ago, the "positives" exceeded the "neutral" + "negatives". Today, the situation is reversed: the "neutrals" + "negatives" represent more than double the "positives". The problem is therefore substantial and rapid.

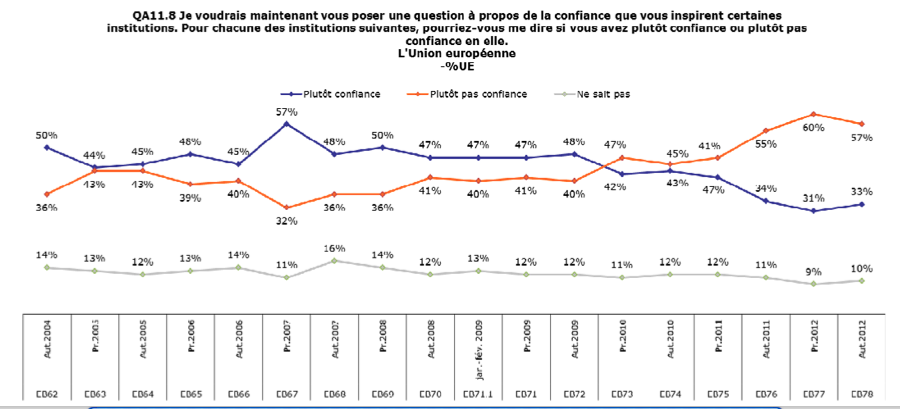

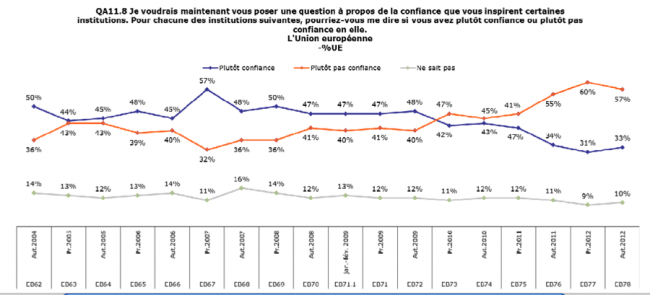

The issue of trust in the European Union confirms this development. The "trust/distrust" lines intersect in 2010. The number of people (57%) who don't really trust is almost double the number who trust (33%). It is in the countries in crisis (Spain, Portugal, Greece, Cyprus, etc.) which are often pro-European, that the fall is the most brutal. But the evolution also affects other countries and not the least: the Germans, the French, even the Belgians are out of Europe.

The evolution is brutal. Five years ago, 65% of Spaniards trusted the EU; today 72% no longer believe in Europe, against only 20% who still adhere to it.

According to figures from Eurostat, mistrust is now the majority in 20 EU countries (the main ones). We can thus distinguish three groups of countries where mistrust prevails: those which had a certain ingrained Euroscepticism (United Kingdom 69%) are joined or even overtaken by those where the crisis exists (81% in Greece!, 72% in Spain , 64% in Cyprus).

Even traditionally "euro-enthusiastic" Italy crosses the bar of 50% distrust (53% distrustful against 31% confident). This feeling also exists in the "rich" countries, less affected by the crisis, which fear becoming poorer and paying (59% mistrust in Germany, 55% in Austria). Even Belgium, despite having a strong Europhile sentiment, is beginning to doubt: 51% distrust against 46%.

In fact, the European Union currently only enjoys majority confidence in seven States (ratio of confidence / mistrust): Bulgaria (60% / 24%), Lithuania (49% / 37%), Poland (48 % / 42%), Denmark (48% / 46%), Estonia (46% / 38%), Malta (46% / 34%) and Romania (45% / 40%). NB: Countries which, it must be recognized, have a secondary weight both in population (barely 1/6th of the total) and in economic or political terms.

This is no longer enough... If there is not a rapid recovery in public opinion, the European project which aimed to "unite states and men" is losing ground. He only walks on one leg, so hobbles, and this state of affairs can never last for long...

Another indicator: foreign exchange reserves

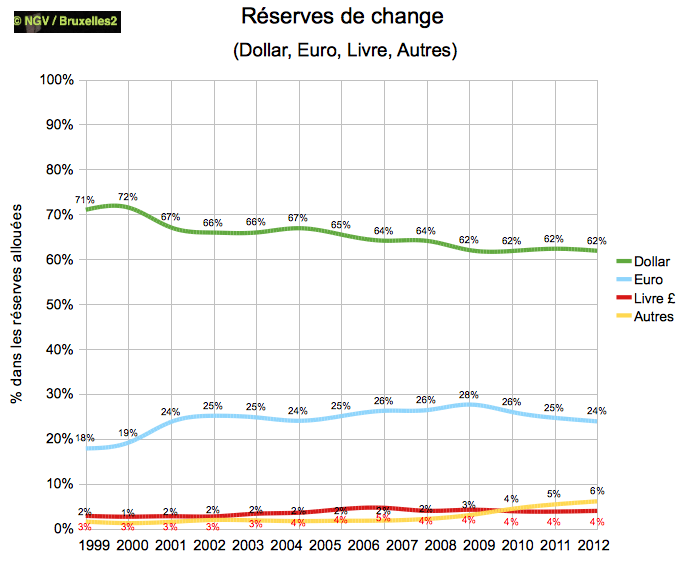

The single currency, the Euro (€) has ceased to be a "safe haven" currency. If we examine the IMF's foreign exchange reserve statistics (*) by putting them into ratios (percentage), we clearly perceive the evolutions and reversals of trend produced by the crisis. The rate of foreign exchange reserves in euros in 2012 fell just below 24%, or roughly the same rate as ten years ago (2002), or even before the introduction of the single currency. In 1995-1996 (if we take the cumulative DeutschMark-Franc-GulderNl-Ecu volume), it was already around 24% (*)! All the gradual rise of the Euro (which reached a peak of 27,6% in 2009) is thus erased.

The Dollar ($), which has been constantly losing ground since the appearance of the single currency, thus falling from approximately 71% of foreign exchange reserves in the 2000s to 62% in the 2010s, stabilizes this position around this figure ( 61,9% in 2012). However, it is not really regaining ground. Which is a sign, in itself, not totally negative for the Euro which could, thanks to growth, regain ground.

The pound sterling (£) which had progressed between 2002 and 2007 (rising from 2,8% to 4,7%) also stabilized its position around 4%. Foreign exchange reserves denominated in other currencies which had fallen at the introduction of the single currency (from 4,7% in 1995 to 1,6% in 2000) and had been relatively stable since (around 1,80%) are increasing rapidly since 2008, thus progressing by one point per year (from 2% to 6%).

(*) When the single currency was introduced, the rate of foreign exchange reserves was 18%, but this rate rose rapidly in the following years at the natural low level of the countries making up the euro zone.

NB: Calculations based on 2012 figures from the "Cofer" database on the basis of "allocated" reserves. It should be noted that only a little more than half of the world's reserves are "allocated": allocated reserves have tended to decrease significantly since the 2000s - thus dropping from 78% in 2000 to 55% today. This figure has been relatively stable over the past three years. And 2012 is even the first year where it did not decrease but increased very slightly (55,6% against 55,3% in 2011)

Read also:

- When democracy becomes an embarrassing detail. A bonus for populism and extremes?

- The first European force is ten years old

Please note: Students from the École Normale Supérieure and the University of Paris 1 Panthéon-Sorbonne are organizing the May 25 a day of reflection on the theme of the crises currently experienced by the European Union and how the EU could emerge from these crises from above. Entitled "Is the European project therefore at a standstill?", the symposium will take place on Saturday May 25 from 10 a.m. at the National Assembly in the Victor Hugo room, Immeuble Jacques Chaban Delmas at 101, Rue de l' university, Paris VIIe. The event is free but registration is required: http://www.weezevent.com/leurope-ne-meurt-jamais